-

Wednesday July 10, 2019

FHA loans: Everything you need to know in 2019

What is an FHA loan?

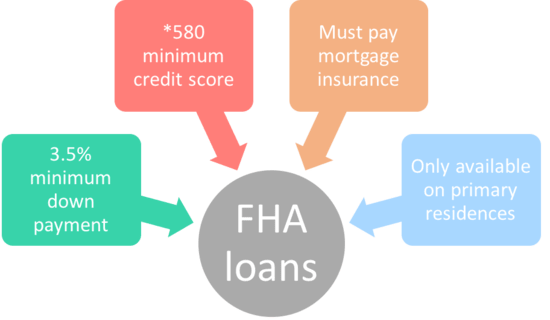

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration, or FHA for short. Popular with first-time homebuyers, FHA home loans require lower minimum credit scores and down payments than many conventional loans. Although the government insures the loans, they are offered by FHA-approved mortgage lenders.

FHA loans come in fixed-rate terms of 15 and 30 years.

How FHA loans work

FHA’s flexible underwriting standards allow borrowers who may not have pristine credit or high incomes and cash savings the opportunity to become homeowners. But there’s a catch: borrowers must pay FHA mortgage insurance. This coverage protects the lender from a loss if you default on the loan.

Mortgage insurance is required on most loans when borrowers put down less than 20 percent. All FHA loans require the borrower to pay two mortgage insurance premiums:

- Upfront mortgage insurance premium: 1.75 percent of the

loan amount, paid when the borrower gets the loan. The premium can be

rolled into the financed loan amount.

- Annual mortgage insurance premium: 0.45 percent to 1.05

percent, depending on the loan term (15 years vs. 30 years), the loan

amount and the initial loan-to-value ratio, or LTV. This premium amount is

divided by 12 and paid monthly.

So, if you borrow $150,000, your upfront mortgage insurance premium would be $2,625 and your annual premium would range from $675 ($56.25 per month) to $1,575 ($131.25 per month), depending on the term.

FHA mortgage insurance premiums cannot be canceled in most instances. The only way to get rid of the premiums is to refinance into a non-FHA loan or to sell your home. FHA loans tend to be popular with first-time homebuyers, as well as those with low to moderate incomes. Repeat buyers can get an FHA loan, too, as long as they use it to buy a primary residence.

FHA lenders are limited to charging no more than 3 percent to 5 percent of the loan amount in closing costs. The FHA allows home sellers, builders and lenders to pay up to 6 percent of the borrower’s closing costs, such as fees for an appraisal, credit report or title search.

How to qualify for an FHA loan

To be eligible for an FHA loan, borrowers must meet the following lending guidelines:

- FICO score of 500 to 579 with 10 percent down or a FICO

score of 580 or higher with 3.5 percent down.

- Verifiable employment history for the last two years.

- Income is verifiable through pay stubs, federal tax

returns and bank statements.

- Loan is used for a primary residence.

- Property is appraised by an FHA-approved appraiser and

meets HUD property guidelines.

- Your front-end debt ratio (monthly mortgage payments)

should not exceed 31 percent of your gross monthly income. Lenders may

allow a ratio up to 40 percent in some cases.

- Your back-end debt ratio (mortgage, plus all monthly

debt payments) should not exceed 43 percent of your gross monthly income.

Lenders may allow a ratio up to 50 percent in some cases.

- If you experienced a bankruptcy, you must wait 12

months to two years to apply, and three years for a foreclosure. Lenders

may make exceptions on waiting periods for borrowers with extenuating

circumstances.

FHA vs. conventional loans

Unlike FHA loans, conventional loans are not insured by the government. Qualifying for a conventional mortgage requires a higher credit score, solid income and a down payment of at least 3 percent for certain loan programs. Here’s a side-by-side

In addition to its popular FHA loan, the FHA also insures other loan programs offered by private lenders. Here’s a look at each of them.

FHA 203(k) loans — These FHA loans help homebuyers purchase a home — and renovate it — all with a single mortgage. Homeowners can also use the program to

refinance their existing mortgage and add the cost of remodeling projects into the new loan. FHA 203(k) loans come in two types:

- The limited 203(k) has an easier application process, and the

repairs or improvements must total $35,000 or less.

- The standard 203(k) requires additional paperwork and applies to

improvements costing more than $5,000, but the total value of the property

must still fall within the FHA mortgage limit for the area.

Home Equity Conversion Mortgage, or HECM — A HECM is the most popular type of reverse mortgage and is also insured by the FHA. A HECM allows older homeowners (aged 62 and up) with significant equity or those who own their homes outright to withdraw a portion of their home’s equity. The amount that will be available for withdrawal varies by borrower and depends on the age of the youngest borrower or eligible non-borrowing spouse, current interest rates and the lesser of the home’s appraised value or the HECM FHA mortgage limit or sales price.

FHA Energy Efficient Mortgage (EEM) program — Energy efficient mortgages backed by the FHA allow homebuyers to purchase homes that are already energy efficient, such as EnergyStar-certified buildings. Or they can be used to buy and remodel older homes with energy-efficient, or “green,” updates and roll the costs of the upgrades into the loan without a larger down payment.

FHA Section 245(a) loan — Also known as the Graduated Payment Mortgage, this program is geared at borrowers whose incomes will increase over time. You start out with smaller monthly payments that gradually go up. Five specific plans are available: three plans that allow five years of increasing payments at 2.5 percent, 5 percent and 7.5 percent annually. Two other plans set payment increases over 10 years at 2 percent and 3 percent annually.

FHA loan limits for 2019

For 2019, the floor limit for FHA loans in most of the country is $314,827, up from $294,515 in 2018. For high-cost areas, the ceiling is $726,525, up from $679,650 a year ago. These limits are referred to as “ceilings” and “floors” that FHA will insure. FHA updates limit amounts each year in response to changing home prices.

FHA is required by law to adjust its amounts based on the loan limits set by the Federal Housing Finance Agency, or FHFA, for conventional mortgages guaranteed or owned by Fannie Mae and Freddie Mac. Ceiling and floor limits vary according to the cost of living in a certain area, and can be different from one county to the next. Areas with a higher cost of living will have higher limits, and vice versa. Special exceptions are made for housing in Alaska, Hawaii, Guam and the Virgin Islands, where home construction is more expensive.

FHA loan relief

Loan servicers can offer some flexibility on FHA loan requirements to those who have suffered a serious financial hardship or are struggling to make their payments.

That relief might be in the form of a temporary period of forbearance, a loan modification that would lower the interest rate, extend the payback period, or defer part of the loan balance at no interest.

- Upfront mortgage insurance premium: 1.75 percent of the

loan amount, paid when the borrower gets the loan. The premium can be

rolled into the financed loan amount.